Several weeks ago, I received an email from one of my blog readers from US. We exchanged some emails chatting about some Chinese pop musicians, and later he expressed his interest in doing business in China. He said that in future his company would register a representative office in China and work on getting Chinese clients, which prompts me to wonder why foreign investors tend to register a rep. office instead of a LLC (limited liability company) to do business in China. So, here comes this post, in which I'll remind interested foreign investor of the regulations that he/she needs to look into before he/she decides to register a business entity in China, also I'll talk about the pros and cons of a rep. office and LLC.

Before you decide to invest in China, you're advised to look through the

Catalog for the Guidance of Foreign Invested Enterprises (Revised 2007) (or,

《外商投资产业指导目录(2007 年修订)》in Chinese), which is a catalog of encouraged, restricted and prohibited foreign investments. Basically, it tells you which industry you are allowed or not allowed to invest in, and in what form, WFOE or JV, etc. Unfortunately, I cannot find an officially translated version of the Catalog. Interested foreign investors may use Google to find unofficially translated English versions of the Catalog. Anyway, don't worry. Foreign investors are allowed to invest in most industries in China. Then, let's look at the pros and cons of a rep. office and LLC.

Pros of

Rep. office:

- No minimum registered capital requirement.

Cons:

- No allowed to conduct actual business (only for liaison purpose);

- Cannot hire Chinese employees directly; Employees sign employment contracts with a qualified HR company (e.g. Beijing Foreign Enterprise Service Group Co., Ltd. or 'FESCO' in short) and employees are then dispatched to work for the rep. office. The service provided by FESCO is not cheap.

- Must pay taxes even if a rep. office does not have any income. The tax payable is calculated on the basis of a portion of a rep. office's expenses.

Pros of

LLC:

- Can conduct actual business in China;

- Can hire Chinese employees directly;

- Pay taxes just like any other Chinese company.

Cons:

- Minimum registered capital requirement: RMB 30,000. (Trust me, nobody would do big business with you if your liability is limited to just RMB 30,000. To make your company look trustworthy, increase the amount!)

Rep. office is only useful for companies that need special permit or license to operate business in certain industries in China, for example, banking or securities. Before these companies can obtain a license to operate their business legally, a rep. office is a reasonable choice to begin with. Foreign universities can also register a rep. office to recruit Chinese students. I would advise most foreign investors to registered a LLC if you're serious about doing business in China.

Of course, there are other business forms you can choose. My objective in this post is to advise foreign investors to go for LLC rather than a rep. office. Don't always assume a rep. office costs you less than a LLC (You pay the registered capital and it's still yours, right?).

You may be interested in having a look at the

Company Law of P.R. China (

《公司法》). By the way, registering a company in China is not so difficult and you don't have to hire expensive lawyers to help, unless your case is complicated and you feel the need to use lawyers. However, if you don't want to waste time on your trips, you may need to hire a professional agent to run errands for you and get your company registered.

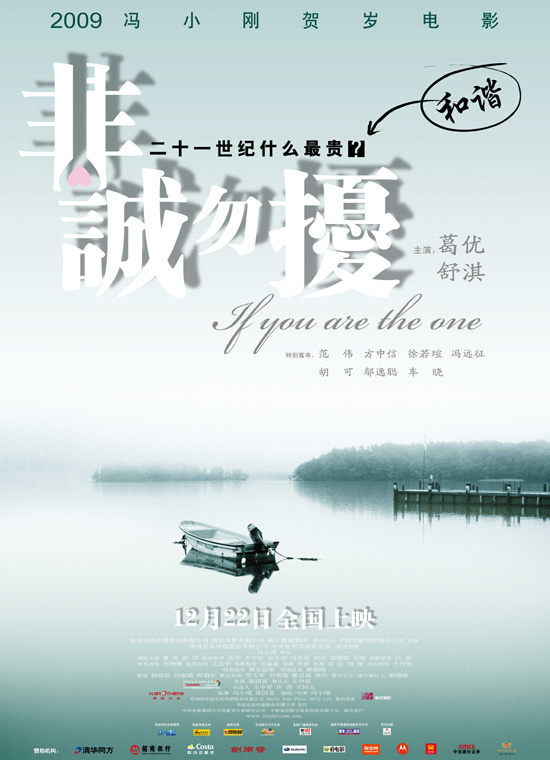

'If You Are the One', a top performer at the Chinese box office (RMB 340 million)

'If You Are the One', a top performer at the Chinese box office (RMB 340 million)